FxPro has grown rapidly in the past 15+ years, and continues to offer a service in South Africa that excels above many others. Is FxPro the right broker for you? Find out more.

- Wide platform range

- Multi regulated incl. FSCA

- Great execution

- ZAR accounts supported

- No real stocks available

- Spreads not the lowest

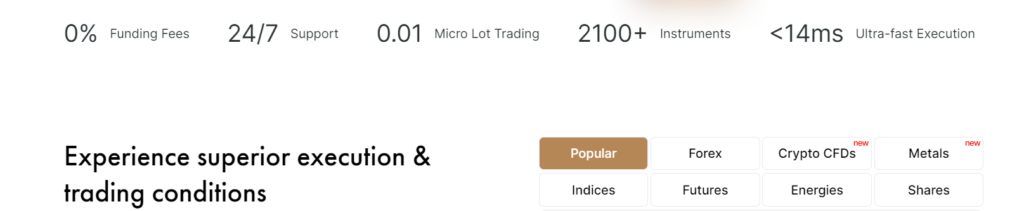

Founded in 2006, FxPro began as a broker based out of Cyprus and has continued to find strength in new territories. In 2013, they expanded their presence to South Africa and have since become one of the leading brokers in the country. Their platforms offer access to over 2100 trading instruments, including forex pairs, indices, commodities and cryptocurrencies.

You will also find various trading tools and resources for both beginner and experienced traders. Competitive spreads, no dealing desk, and reliable execution all continue to support the growth of FxPro from its’ inception, up to the point of having had more than 2million trading accounts opened. All this, along with their commitment to transparency and security, means that FxPro continues to cement its reputation as a trusted broker in South Africa.

FxPro South Africa Reviews

FXpro has a strong reputation among South African traders, with many praising the broker’s overall trading experience and customer support. Additionally, the fact that FxPro is regulated by the FSCA adds to its trustworthiness among traders in the country.

Across the web, South African traders have generally continued to review FxPro favorably with the majority rating it 4 to 5 stars. Some reviewers noted the reliable execution speeds and high levels of customer service, while others commented on the ease of use and functionality of the trading platform. Overall, FxPro has a strong reputation among South African traders, and it is easy to see why from the services provided that we are looking at in further detail below.

Is FxPro regulated in South Africa?

The answer to this question is yes, FxPro is regulated in South Africa by the Financial Sector Conduct Authority (FSCA) under license number 45052. This means that the company adheres to all local laws and regulations, ensuring the safety of traders’ funds and fair trading practices.

Additionally, FxPro is also regulated by several other reputable financial authorities worldwide, including the UK’s Financial Conduct Authority (FCA), Cyprus’ CySEC, and the Bahamas’ BSC. Overall, traders can trust that their investments are in trusted hands with regulatory support.

FxPro Fees

Spreads with FxPro – The spreads offered by FxPro vary depending on the account type and market being traded, but generally start from 0.6 pips for major currency pairs such as EUR/USD.

Non trading fees – FxPro does not have any hidden trading fees, and all costs are clearly outlined in the broker’s contract specifications. Whilst it is not hidden, there is an inactivity fee should you not use your account for an extended period (12 months+).

Trading fees – Some potential trading costs to be aware of include overnight funding fees, and currency conversion fees for non-base currencies held in a trader’s account.

FxPro Trading Platforms

MT4 – The FxPro MT4 platform is a popular choice among traders due to its user-friendly interface and range of advanced trading tools. It also offers automated trading options through Expert Advisors and custom indicators. Additionally, the platform allows for mobile trading through its mobile app.

cTrader – The FxPro cTrader platform is designed for advanced traders and offers high-speed execution and advanced charting tools. It also allows for automated trading through cBots and a range of customizable indicators. Like the MT4 platform, it also has a mobile app for on-the-go trading.

FxPro account types

There are three main account types with FxPro: the Standard account, Premium account, and VIP account. Each account type differs in terms of trading cost, minimum deposit amount, and access to features such as market analysis tools and personalised service from a dedicated account manager.

| FxPro MT4 | FxPro MT5 | FxPro cTrader | FxPro Instant & Fixed | FxPro Platform | |

| Instruments | Forex, Metals, Indices, Energies, Futures, Shares, Cryptocurrencies | Forex, Metals, Indices, Energies, Futures, Shares, Cryptocurrencies | Forex, Metals, Indices, Energies | Forex, Metals, Indices, Energies, Futures, Shares | Forex, Metals, Indices, Energies, Futures, Shares, Cryptocurrencies |

| Min Position Size | Micro Lot | Micro Lot | Micro Lot | Micro Lot | Micro Lot |

| Trading Fees | Marked-Up floating spreads (zero commission) | Marked-Up floating spreads (zero commission) | Reduced Spread plus $35 per $1 million traded (upon opening and closing a position). | Marked-Up floating spreads, fixed spreads | Marked-Up floating spreads (zero commission) |

| Execution | Market | Market | Market | Instant | Market |

| Trading Platforms | FxPro Edge, Mobile, MT4 multi platform | FxPro Edge, Mobile, MT4 multi platform | cTrader multi platform support | FxPro Edge, MT4 multi platform | FxPro Edge, Mobile, MT4 multi platform |

FxPro leverage

FxPro offers up to 1:500 leverage on its platforms, allowing traders to potentially maximize their profits on trades. However, it is important to note that increased leverage also increases risk. It is important for traders to use proper money management techniques when trading with high leverage.

FxPro Demo Account

FxPro does offer demo accounts for traders to practice and hone their skills before investing real funds. The demo account is available for all three account types and comes with virtual funds of $100,000 for traders to use.

The demo account offered by FxPro is as quick and easy to open as the click of a few buttons, and the trading environment provided is as close to the real thing as you can get before you actually fund your account and get up and running.

You will see all the FxPro technical analysis contained within the platform including live charts, 33 technical indicators and a range of drawing tools to support your trading decisions.

FxPro Deposits & Withdrawals

The FxPro minimum deposit is R1800 ZAR (South African Rand) or the exchanged equivalent to $100 USD. This level of minimum deposit allows traders of various levels to get started without overexposing themselves to too much initial outlay. The recommended deposited suggested on the FxPro website is $1000, or 17,000 ZAR; but it is worth noting that this is just their recommendation and not actually the minimum deposit with FxPro as highlighted above. There are various reasons for this higher recommended deposit level, not least that it helps the broker with its’ long term business, but also that it allows traders more flexibility in trading strategy that can be executed with the minimum position sizes supported.

You will find a variety of deposit methods provided for; including bank transfer, debit cards (Visa, Mastercard), and digital payment solutions such as Paypal, Neteller, and Skrill. Regardless of the regulated entity of FxPro you register with, there are no fees charged by the broker on any deposits, but you may have fees charged by your own bank when making a transfer if you choose that method.

FxPro withdrawals are available through a variety of different methods, and withdrawals are actioned within one business day. Some clients have reported difficulties with the withdrawal process and slow customer support response times in resolving issues but it is worth noting that any issue in withdrawals is likely to be highlighted and flagged up, whereas positive experiences in this area are less likely to be covered.

It is highly advisable to check out the policies relating to withdrawal methods, and KYC requirements before you open an account and progress to the point where you want to withdraw.

FxPro welcome bonus

FXpro does not currently offer a welcome bonus for new traders. However, they do provide various promotions and offers for their existing clients such as cashback on trading volume and free VPS services.